oregon statewide transit tax form 2020

Self-employed individuals should use the new rate when first reporting. This will allow employers to use one payment voucher to report payments of the statewide transit tax in addition to the taxes on.

The reporting requirement will be enforced starting with Form W-2 filing for tax year 2019 due date of January 31 2020.

.jpg)

. Go to the Reports tab and select Employees Payroll. 2020 Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Oregon On average this form takes 12 minutes to complete. Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon.

01 Date received Payment received Submit original formdo not submit photocopy. Form OR-STI Oregon Statewide Transit Individual Tax Return. Theres no need for taxpayers to file any additional forms or contact DOR for this postponement.

For EFT information call 503-945-8100 option 4 then option 1. If an employee is an Oregon resident but your business isnt in Oregon you can. 10-18 Date received Submit original formdo not submit photocopy Business name Social Security number SSN Employee last name Total subject wages Statewide transit tax withheld First initial 1.

Effective January 1 2021 the tax rate increased to 07837 of the wages paid by an employer and the net earnings from self-employment for services performed within the TriMet District boundary. Choose Payroll Detail Review. This change is effective for calendar year 2019 Forms W-2 due to employees and the Department by January 31 2020.

Form or-stt-2 2020 oregon statewide transit tax 2020 oregon statewide transit tax payment voucher form or-stt-1 2020 form or-stt-v oregon statewide transit tax 2021 is oregon transit tax deductible Create this form in 5 minutes. Effective July 1 2018 employers must begin withholding the new 01 Oregon statewide transit tax from the wages of Oregon residents regardless of where the work is performed provided the employer has nexus and the wages of nonresidents who perform services in Oregon. For quarterly filers enter 1 2 3 or 4 to indicate the tax quarter in the quarter box.

Make your pay - ment using the payment coupon Form OR-OTC-V or through the departments electronic fund transfer EFT. Form OR-LTD and OR-TM Transit Self-Employment Tax Returns Taxpayers who havent filed their 2020 income tax returns but expect to file by the May 17 2021 deadline only need to file and pay any tax due with their return by May 17. In a matter of seconds receive an electronic document with a legally-binding eSignature.

Corporation Business and Fiduciary e-filing. Recently promulgated Oregon Department of Revenue regulations require employers to report the statewide transit tax in Box 14 of Form W-2 with the designation ORSTT WH for example ORSTT WH - 1500. Form OR-STI Instructions Oregon Statewide Transit Individual Tax Return.

Oregon tax filing and payment deadline from April 15 2021 to May 17 2021. Heres how to do that. How to figure the transit tax.

Ad Register and Subscribe Now to work on your OR OR-STT-1 more fillable forms. When to file the transit tax Your transit tax is reported quarterly using the Ore-gon Quarterly Tax Report Form OQ. Oregon Tax e-File Cigarette and Tobacco Uniformity Program.

Oregon Department of Revenue 19120001010000 Form OR-STT-2 Statewide Transit Tax Employee Detail Report Office use only Page 1 of 1 150-206-006 Rev. Form OR-STI-V Instructions Oregon Statewide Transit Individual Tax Payment Voucher Instructions. The 2020 Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Oregon form is 1 page long and contains.

When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. Beginning in tax year 2020 the Department will add the statewide transit tax program to Form OR-OTC-V Oregon Combined Payroll Tax Payment Coupon and discontinue use of Form OR-STT-V Statewide Transit Tax Payment Voucher. Oregon statewide transitem while on the go as long as you have a stable connection to the internet.

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. The department amended OAR 150-316-0359 in the fall of 2018 to require reporting of statewide transit tax withheld in Box 14 of the Form W-2. Due date For annual filers agricultural employers or Form OA domestic filers the statewide transit tax payment is due on the last day of the month following the end of the tax.

Therefore the signNow web application is a must-have for completing and signing 2021 form or stt 1 on the go. Corporate Activity Tax training materials. Ad Fill Sign Email OR OR-STT-2 More Fillable Forms Register and Subscribe Now.

Oregon Statewide Transit Tax Takes Effect July 1 New Forms Now Available. The statewide transit individual STI tax helps fund public transportation services within Oregon. Page 1 of 1 150-206-006 Rev.

Corporation estimated excise or income tax. 06-18 Oregon Department of Revenue 2018 Form OR-STT-2 instructions Oregon Statewide Transit Tax Employee Detail Report Form OR-STT-2 Instructions General information The new statewide transit taxpart of House Bill HB 2017 from the 2017 Legislative Sessiontakes effect on July 1 2018. The knowledgebase indicates in article 104026 that this is supposed to be updated as of the 4th quarterly update this month which I believe was scheduled for the 20th.

Oregon Department of Revenue 19112101010000 2021 Form OR-STT-1 Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. Use professional pre-built templates to fill in and sign documents online faster. Employers should apply the new rate with their reporting related to wages for the first quarter of 2021.

The tax is one-tenth. Lets run a Payroll Detail Review report to check your employees tax deductions. Get access to thousands of forms.

As a result interest and penalties with respect to the Oregon tax filings and payments extended by this Order will begin to accrue on May 18 2021. Corporation excise and income tax filing information and requirements. Oregon employers must withhold 01 0001 from each employees gross pay.

Oregon WR form missing Statewide Transit Tax 2020. Purchase Oregon cigarette tax stamps. I have a client that is missing their Oregon Statewide Transit Tax values on their Oregon WR form.

Form OA domestic filers enter a 4 in the quarter box regardless of the quarter in which payroll was paid to employees. RMN over 1 year ago.

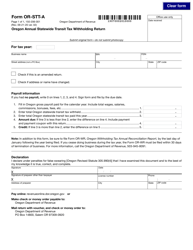

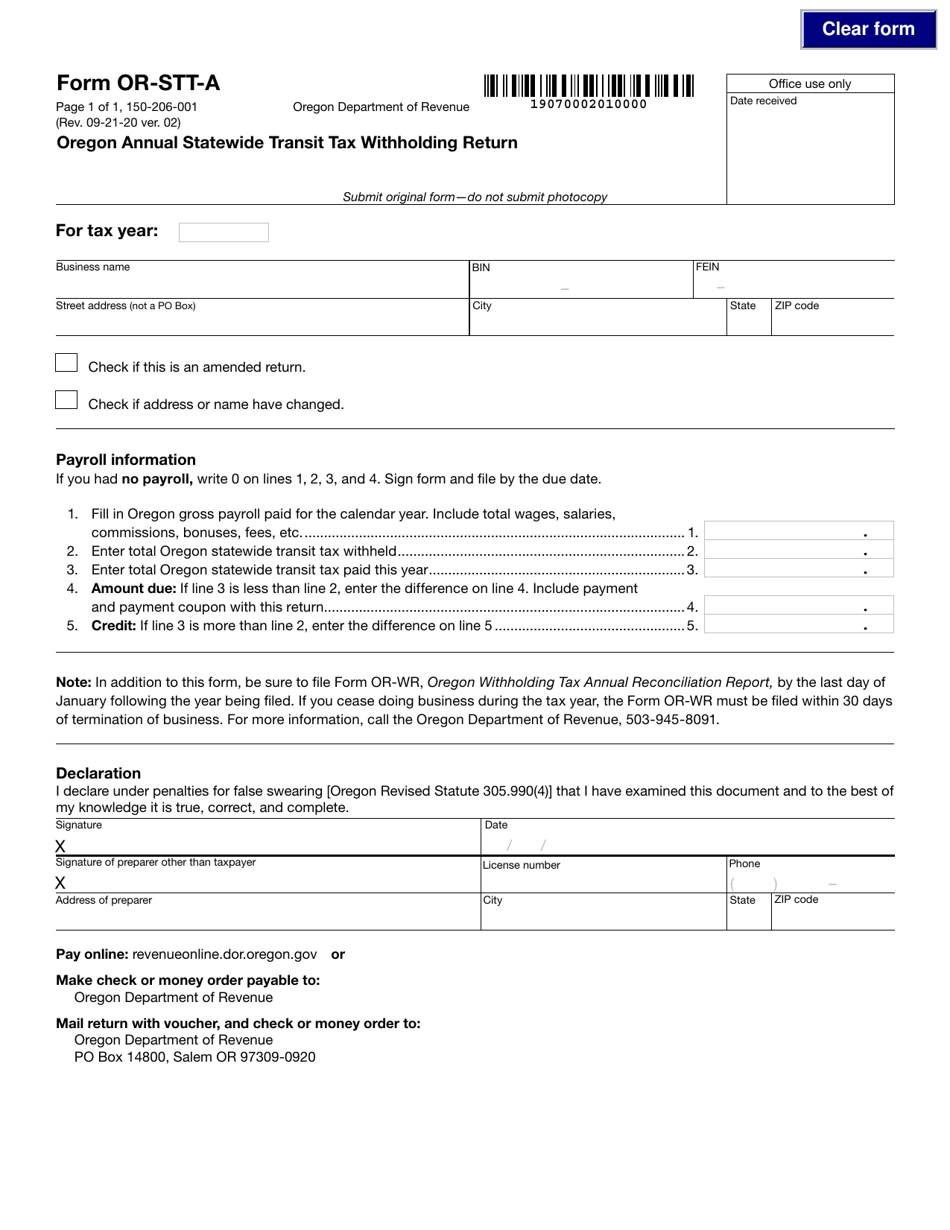

Form Or Stt A 150 206 001 Download Fillable Pdf Or Fill Online Oregon Annual Statewide Transit Tax Withholding Return Oregon Templateroller

Form Or Stt A 150 206 001 Download Fillable Pdf Or Fill Online Oregon Annual Statewide Transit Tax Withholding Return Oregon Templateroller